Despite a tightening policy shift from the Fed and ECB, the two most significant DM central banks, and a broad tightening of financial conditions to start off the year, EM assets are outperforming. We see this strength as fundamentally warranted and a reflection of the compelling macro setup in EM asset markets. For the reasons highlighted below, we expect further outperformance of EM assets over the course of 2022. We would note that these highlighted trends are in reference to the broader EM complex, in particular EMs ex-North Asia, with important differentiation by country and region.

Growth and Inflation:

We expect strong absolute levels of global growth to continue as global business capex and residential investment upswings continue, inventory drawdowns are rebuilt, and service sectors make a further recovery as COVID headwinds dissipate.

On a relative basis, the fiscal tightening impulse in the US should help shift relative growth rates in favor of EMs, where comparatively tight-fisted finance ministers generally indulged in considerably less COVID-related fiscal easing than US policymakers.

Inter-DM fiscal policy divergences also support EMFX, with the more appropriately staggered EU Recovery Fund support in Europe (in contrast to the US’s fiscal hangover) keeping relative growth dynamics in favor of the EUR in 2022.

China’s recent policy easing and the trough in the Chinese credit impulse is also lining up to support EM growth in 2022, with positive implications for commodity-exporting EMs. EM rallies have followed every other Chinese easing cycle.

Source JDI Research

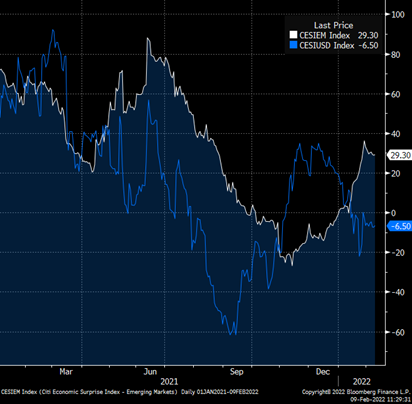

5. In this cycle, commodity-exporting EMs are additionally supported by a number of trends including nearly a decade of commodity-sector underinvestment, strong DM goods demand, and a global green transition which are helping to keep commodity prices well-bid. These divergent forces have already started supporting EM growth which has been surprising to the upside, in contrast to the relative weakness recently seen in US data.The below chart indicates that the Citi EM Economic Surprise Index (white line) is positively surprising, in contrast to the Citi US Economic Surprise Index (blue line), which is currently in negative territory. While many EMs have been impacted by the same inflationary forces that were prevalent globally in 2021, we see scope for inflation in certain EMs to favorably diverge from global trends in 2022.

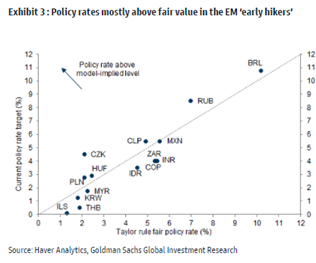

6. The fight against inflation, i.e. tightening of financial conditions has already occurred in some EMs. Many of the EMs with elevated inflationary pressure did not take the Fed and ECB’s ‘transitory’ line and have already been tightening throughout much of 2021 (e.g. Brazil, Russia, and the Czech Republic), often with hikes that have brought policy rates to levels in line with an orthodox Taylor Rule approach. The ‘long and variable lags’ of these 2021 monetary tightening decisions are likely to weigh on EM inflation relative to DM economies, where policymakers are only just now beginning their tightening pivot from levels that are historically diverged from the past rule-based approaches.

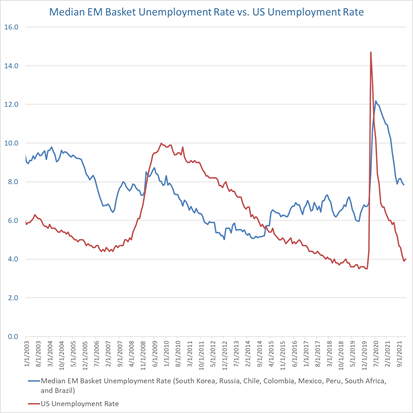

7. Output gaps and labor markets across most of the EM complex have more slack than in DM markets and EM economies are unlikely to be able to sustain elevated pricing power in labor markets and domestic service sectors. As base effects from global goods inflation peak in the coming quarters, we believe EM inflation will be characterized by the lagged impact of 2021’s monetary tightening and the relatively softer core services inflation dynamics created by negative output gaps and labor market softness. In contrast, in DMs like the US, while fading goods CPI base-effects will likely bring some reprieve to headline inflation figures in 2022, the late monetary policy response, underlying heat in core services (particularly rents) and wage growth strength could present a comparatively more challenging inflationary dynamic.

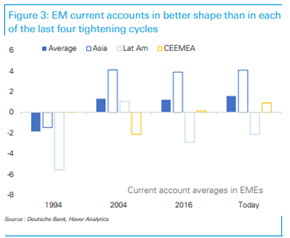

8. Relative to prior Fed tightening cycles, the capital inflow and balance of payments backdrop for EMs today is comparatively favorable. As Figure 3 from DB shows below, EM current accounts in most regions are better positioned today than at the start of the last four tightening cycles. In addition to the current account strength, most EM balance sheets in this cycle have sufficient reserve levels and foreign liabilities that are primarily FDI or denominated in local currencies.

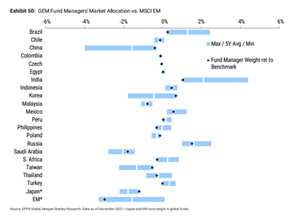

9. A related bullish factor for EMs is the lack of foreign inflows over the last two years, resulting in near trough foreign positionings in many EMs and across EM asset classes. The light positioning is illustrated in the below charts from DB, MS, and BofA. In EM equities, global fund managers are near record UW EM equities relative to their benchmarks (per MS), while a January 2022 BofA Global Fund Manager Survey found a nearly -1 st deviation underweight relative to historical norms.

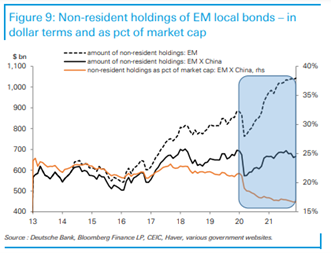

Per the below charts, a similar set-up can be seen in local currency bond markets (particularly for EM ex-China), where non-resident holdings as a share of outstanding bonds are approaching decade lows.

10. EM current accounts are largely in balance, with most EMs possessing strong and rising FX reserve buffers. Moreover, with limited foreign capital having entered EMs over the past two years and foreign positioning already quite light, less foreign capital is at risk of retreating from EMs as DM central banks move to tighten this cycle.

Risk Premium and Valuations:

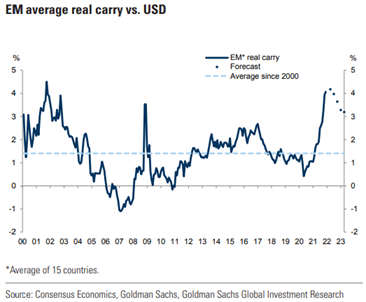

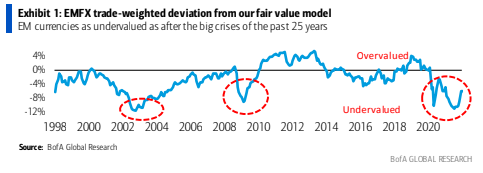

11. In large part, as a consequence of the front-footed EM monetary policy response to the recent inflation surge and two years of limited foreign participation, many EM assets are now priced at excessively distressed valuations. In EMFX, the below chart from GS shows relative EM real carry differentials currently stand at levels that have only been observed a few times over the past two decades.

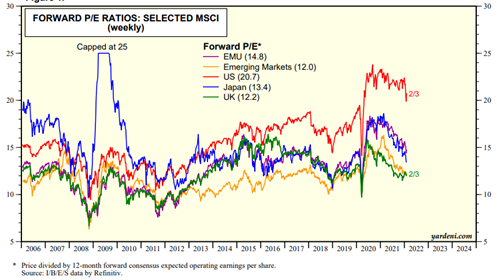

The elevated levels of real carry yield differentials are at EMFX REER valuation levels that are near twenty-five-year lows (per BofA) and EM equity markets are also priced at a discount to global markets.