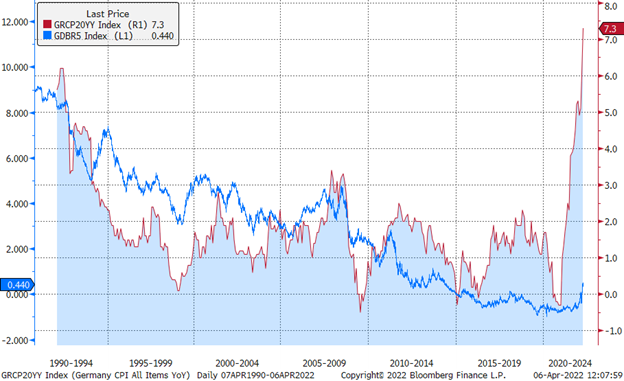

Upward growth revisions and a robust US labor market challenges the goldilocks soft landing narrative that had driven the rally in risk assets in January. The risk is skewed higher in terminal rates and if data continues to be strong then the Fed may be faced with having to hawkishly re-pivot or allow inflation to be higher for longer.

January was an exceptional month for risk assets. Euro Stoxx 50 rose by 9.75%, its best January in 30 years, and Nasdaq +10.62%, the best since 2001. Meanwhile, the USD had its worst January since 2011.

Underpinning this rally was the market pricing a “Goldilocks soft landing” scenario, where falling demand in key developed markets would generate enough disinflation to allow the Fed to cut rates in the second half of this year, while the China reopening and easing energy prices would spur economic activity enough to avoid a hard landing.

This viewpoint was supported by a clear shift in Fed communication and actions since November. Far from the somber tone we saw at Jackson Hole, Fed speakers have reacted to falling CPI with optimistic talk of a soft landing and the risks of overtightening.

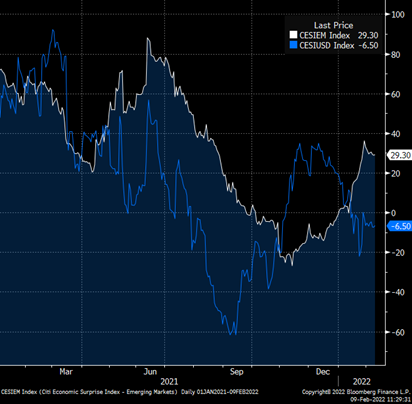

Data had also supported the thesis that a hard landing is not actualizing. As JPM has noted, “after reaching expansion lows in November, the global manufacturing and service-sector PMIs jumped in January, with constructive news on orders and inventories, along with a marked improvement in buiness expectations for growth this year.”

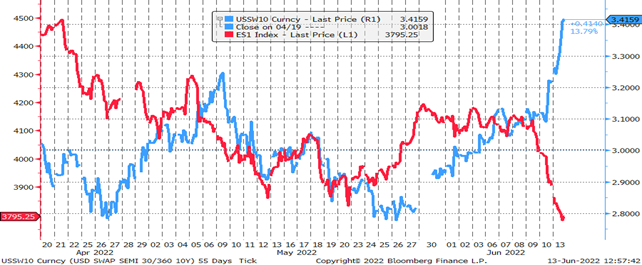

Last Wednesday, Powell added fuel to this narrative. He explicitly refrained from pushing back on the divergence between the market pricing for 2023 rates (which showed ~50bps of *cuts*) and the Fed’s own dots from December. Furthermore, he did not push back against the easing in Financial Conditions in the last 6 weeks. He also mentioned “disinflation” 10 times in the press conference. It is not a stretch to say the tone of the press conference veered towards “mission accomplished”.

As one would expect, the market rallied and the USD sold off. Our first response was one of caution. This was creating, from our perspective, a very unstable equilibrium that could eventually catalyze an adverse asymmetric reaction in risk assets.

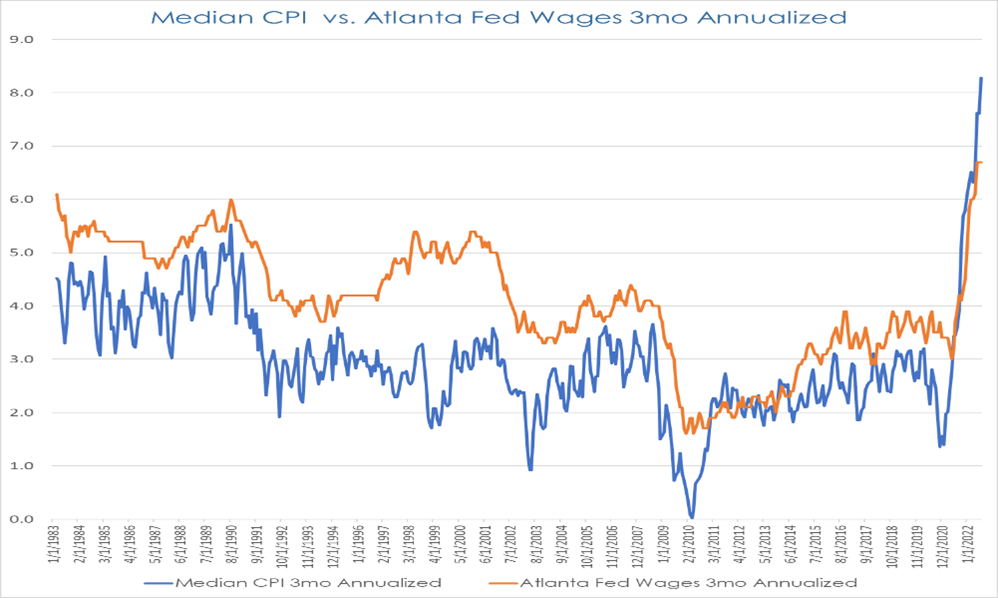

The strength in the US and global economy was at the center of our assessment heading into this year, supported by the easing in FCI, which was not consistent with the disinflationary trend we had seen in Q4.

In our view, if the US economy was stronger than the Fed assumed, then the Fed may need to re-pivot hawkishly, or, perhaps, they are comfortable with a higher level of inflation in aggregate. If data began to surprise to the upside, this would lead to a volatile repricing in markets, as the market had moved so much pricing into the soft, disinflationary landing.

While we saw the risks as distributed to the upside for US growth, we did not expect this view to be so clearly supported by January’s non farm payrolls data.

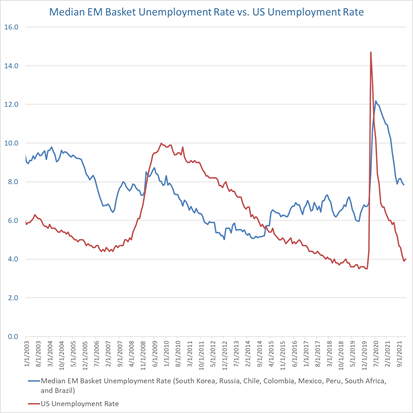

Put simply, this payroll report was extraordinarily strong relative to expectations and for this stage of the cycle. The headline job gains of 517k were 3x expectations, and it brought the unemployment rate down to 3.4%, a 50 year low. Average weekly hours rose 0.3 hours to 34.7 hours, resulting in total hours worked rising by 1.2%, an exceptionally strong reading. Revisions were positive, and the participation rate rose to 62.9%, a cycle high. To highlight, on an unadjusted basis, employment contracted by 2.5mm so the correct way of viewing this number is that the contraction in employment was less than any January back to the mid 90s. Also, average hourly earnings “only” rose by 0.3%, in line with expectations. However, what is clear is that the totality of the data does not show a significantly weakening labor market or imminent recession. Instead, the US labor market has remained remarkably resilient in the face of the tightening delivered so far.

While this NFP report is only one piece of data, the ISM Service report on Friday was also much stronger than expected and showed a re-acceleration in US service sector activity. There are many indicators that we watch closely, which also give us the conviction that risks in the US economy are skewed to the upside. First, most of the US data weakness in Q4 came from ‘soft’ survey-based measures of growth, with ‘hard’ data broadly holding up throughout the quarter, and now accelerating in the January data we have received so far. Our NLP approach to gauging consumer and business confidence and the prevailing economic narrative suggests the near-term risk for US animal spirits is to the upside - raising the likelihood that the ‘soft’ survey data we saw in Q4 starts to catch higher towards the (now improving) hard data.

Second, the daily credit card spending data we track on the US consumer shows a marked acceleration in spending in January - an improvement that suggests the risks are to the upside for January retail sales - especially in light of the acceleration in personal income implied by Friday’s NFP report and the January COLA increase for social security recipients. Finally, we believe the FCI easing that’s occurred since October is starting to reverse some of the tightening effects on US demand felt in 2022.

One area where we see this impact already is in the US housing data we follow, which suggests the US housing market supply is starting to tighten up, with house prices already stabilizing and home sales off their Q4 lows. Factoring in the right tail risk of a re-acceleration in commodity prices caused by China’s reopening and the still unresolved capex restraint in the energy sector raises the probability that the market and Powell have overestimated the disinflationary forces in the economy.

How the Fed and Powell react to this number (beginning on Tuesday) will be central to the path of assets in the near term. On balance, we think Powell is unlikely to shift course so soon after last Wednesday's press conference. However, if data continues to remain strong, there are only two options for the Fed

a) Hawkish Re-Pivot: Creating a policy driven hard landing: Higher terminal rates, sharp curve re-flattening, equities weaker, USD stronger.

b) Dovish Higher-for-longer: Resulting in no landing: Higher terminal rates, moderately stronger USD, higher inflation swaps

In both scenarios, we see upside to 2023 rates and one major theme playing out, that of divergence.

While the US economy is showing remarkable resilience to the level of high interest rates, other economies are either already experiencing harder landings like the UK, Sweden, and New Zealand or at a significant risk of entering one like Canada. These central banks will not be able to hold rates high for long or re-accelerate hikes, so these rates markets will increasingly diverge as they move forward through the year. This divergence is the key difference relative to last year, and we are still in the early stages of this trade.

Overall, the market is now aware of the risk we outlined to investors last week. However, we believe there is still a strong bias to support and further price Goldilocks: there are still 35 bp of rate cuts priced for this year, and equities are still close to the local highs. We may see a short-term relief rally if Powell does not shift his tone on Tuesday. However price action in the last 48 hours shows the low margin for error for this scenario, and the next CPI report will be pivotal.