The last quarter was a regime shift to a world where economic growth is no longer at the center of monetary policy and central to international relations. This shift has been catalyzed by inflation and the invasion of Ukraine and it will shape the macro and geopolitical outlook for the foreseeable future.

The events of the first quarter of 2022 will have historical consequences, as well as shaping the near-term political and macro backdrop. The confluence of a historical inflation shock, central bank policy shifts, and a tragic war in Europe led to levels of market volatility that are only seen in the most stressed market environments.

As we head into the 2nd quarter, the market is pricing in 245bps of hikes for 2022 in the US, up 180bps from the start of this year with 50bp hikes now the modal estimate for the May, June and July meetings.

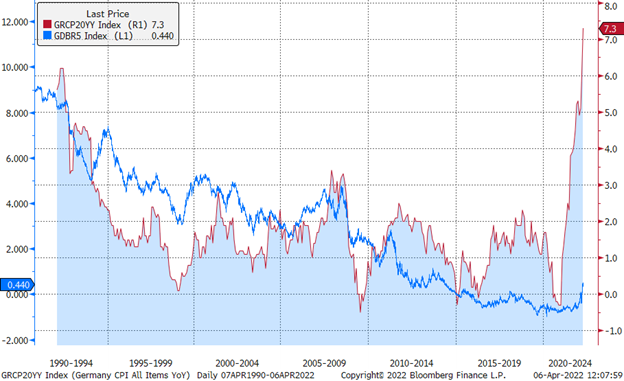

Oil is above $100bbl up 30% ytd, German inflation is at 7.3%, the highest level since reunification, and Sberbank market cap has fallen from EUR86bn on January 1 to EUR225m following unprecedented weaponization of sanctions in response to Russia's invasion of Ukraine.

German 5y Yields Blue / Germany YOY CPI Red

The magnitude of these moves reflects a market regime shift, or more technically, the market repricing the distribution of asset price returns in a non-linear fashion. Specifically, there were two significant regime shifts in the first quarter:

A) A shift by the Fed (and with that other DM central banks) that the inflation backdrop would require a much sooner and sharper rate hiking path. Like the scene in Jaws, central bankers are realizing that “we are going to need a bigger cycle”.

B) The invasion of Ukraine, which resulted in

(i) weaponization of sanctions in an unprecedented fashion

(ii) the largest shift in European defense policy in 60 years

(iii) a structural shift in European energy policy

(iv) the end of Russia as a high-quality investible region for the foreseeable future. In the space of a few days, Russia went from an emerged economy to frontier status with irrevocable damage from an ESG perspective.

(v) a possibly long lasting shock to food supply chains which will have a exorbitant effect on low income developing economies with social unrest, political turmoil and fiscal risks as a consequence (this is already happening in Egypt, Sri Lanka and Peru).

The downstream impacts of what has happened in Q1 are numerous and have already resulted in major asset price movements. However, there is one clear consistency: in both the shift in monetary policy and the policy response to Russia, growth was superseded as a policy priority. Politically, there is strong public support for the sanctions packages, and fighting inflation is the number 1 issue for voters ahead of the US midterms. In effect, the global policy backdrop, political environment, and public sentiment have shifted hawkish.

With this as the macro-political backdrop, there are many market implications. The bottom line is that the longer inflation is allowed to continue, the more severe the policy measures will be necessitated, and with that the greater the risk of significant growth or equity market correction.

1. Persistent inflation = Higher rates

The US inflation problem is not easing, it is broadening. Per Goldman Sachs, their comprehensive labor force measure shows the US labor force at the most overheated level in the postwar period, both in absolute terms and relative to the population. 2y real interest rates moved nearly 100bps less negative from the lows in March, but they are still -100bps and 100bps below pre COVID levels, and 200bps below levels seen in 2018. Indeed, US financial conditions eased throughout March, driven by an exceptional rally in US equities, and remain meaningfully easier than any period pre-COVID. This is a big problem for the Fed, even after the historic increase in nominal interest rates this quarter, financial conditions have barely tightened relative to historical averages. If inflation and inflation risk premium do not fall, rates will need to be much higher to tighten financial conditions to the level necessary to get control of inflation.

US 2y Real Interest Rates - Still well below recent and historical averages

2. The downside risks to equities continue to grow

The corollary to this point is that further equity market increases are unwelcome, as they signal to the Fed that prevailing financial market conditions remain too easy. As we wrote in 31JAN “this Fed wants to be long optionality, not short a policy put to the market. The dominant variable that will determine the Fed policy pathway is not the stability of equity markets, it is the path of inflation over the next 3 quarter”. Not only is the Fed put gone, but equity market rallies also increase the chance of even more aggressive policy tightening.

3. European rates will remain high with upside skew

While the European economy has meaningful structural differences to the US, 2y European real interest rates are -390bps vs the 5y pre Covid average of -140bps. A lot has been priced in quickly into the European interest rate curve, but real rates are more, not less negative due to the increase in inflation risk premium. This type of monetary policy stance will become politically untenable, especially for the northern European economies. The risk remains skewed to the upside in European rates, with fiscalization of inflation placing increased pressure on fiscal balances. Indeed, with pressure growing for more aggressive sanctions on Russia, the risk to the inflation outlook in Europe is tilted to the upside, even as German policy makers in particular try to push back against more sanctions targeting Russian gas.

4. Trading the cycle means EM can continue to rally

As we noted in our note 11 Reasons Why Emerging Markets Will Roar in the Year of the Tiger, tightening global financial conditions, commodity market strength and high nominal interest rates, is an environment which can support certain EMs. This played out in 1Q it is a theme that will work well in a world where growth begins to be priced down in DM and curves continue to invert. This is the powerful effect of the fact that EM moved ahead of DM in their tightening cycles last year and are now in position to capitalize as the outlook for asset returns in DM deteriorates on a real and nominal basis.

In sum, despite the moves in global rates markets and the substantive shift in policy, the central macro issue of inflation has not eased, it has worsened. The level of policy tightening that may be necessary may, still, be much greater than what is currently priced, and the hawkish shift in policy, politics and geopolitics means the tolerance level for a meaningful hit to growth and equity markets is high. The longer inflation is allowed to rise, the harder it will be to affect the level of tightening without a meaningful growth or equity market correction, and that risk means terminal growth rates will be priced lower, which can help continue to support higher yielding EMs. Structurally, this is not a time to be short volatility or convexity, it is an inflationary environment, only one that has had fuel added to its fire.

COVID Update

World COVID cases fell last week, with cases falling in Asia, Europe, CEEMEA, Latin America, and the US. However, unlike the improving COVID environment for most of the world, China’s outbreak continued to rise, with daily cases on Sunday hitting a record 13,146. In Shanghai, most of the city’s ~25 million people are under strict stay-at-home orders, with recent reports suggesting the outbreak in the city has been getting worse. As the chart below shows, China’s Omicron wave is unlike anything the country has seen since March 2020 and is the first real test of the country’s zero-COVID policy approach against the significantly more infectious Omicron variant.

Calvion’s View: We continue to see significant risks from China’s current COVID outbreak. The current combination of elevated cases, the more infectious Omicron variant, and continued adherence to strict zero-COVID policies creates additional near-term risks to Chinese growth and global supply chains. However, COVID risks look limited outside of China, with the potential for continued recoveries in COVID impacted service sectors over the course of the year.

“Economic and market forecasts presented herein reflect our judgment as of the date of this presentation and are subject to change without notice. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts and figures are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Information herein has not been reviewed or approved by either a Fund’s auditor or administrator and is subject to change. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Consult your financial professional before making any investment decision.”